What is a Strata Report? Your Essential Guide Before Buying Property

When it comes to buying or managing a property within a strata scheme, one tool that is often overlooked, but absolutely essential, is the strata inspection report. Also known as a pre-purchase strata inspection report, this detailed document gives prospective buyers a clear picture of a strata-titled property before making a commitment.

Purchasing a strata, community, or company-titled property means taking on shared responsibilities for the entire complex. Understanding the insights a strata report provides is crucial, not just for buyers, but also for current owners and anyone involved in property decisions.

BeSafe Property Inspections recognises the value of this information. Investing in a thorough strata report can prevent unexpected costs and save thousands in the long run, helping to ensure that a property investment serves its owner rather than becoming a financial burden.

In this guide, we’ll walk you through everything you need to know about strata reports, including what they reveal, why they matter, and how to use them to make informed, confident property decisions.

Key Takeaways:

- Essential Insight Before Purchase: A strata report provides critical information on a property’s financial health, management quality, and legal obligations, helping buyers make informed decisions.

- Beyond Standard Inspections: Unlike a building inspection, a strata report evaluates management practices, levies, insurance, by-laws, and disputes that impact long-term ownership.

- Financial and Legal Transparency: The report highlights special levies, sinking fund status, insurance coverage, and ongoing legal disputes, reducing the risk of unexpected costs.

- Risk Assessment: Buyers can identify major building defects, management issues, and restrictive by-laws, allowing them to negotiate, plan for future expenses, or walk away from high-risk properties.

- Professional Expertise Matters: Licensed strata inspectors interpret complex records, ensuring accurate, actionable insights that protect property investments and support confident purchasing decisions.

What is a Strata Report?

A strata report is a professional assessment of a strata-titled property, providing key information on its management, financial status, and operational practices. Prepared by licensed strata inspectors, it draws on official records to give prospective buyers a clear understanding of the property and the responsibilities associated with ownership.

It covers critical information such as the ownership framework, voting rights, building maintenance history, by-laws, and financial records of the owners’ corporation (also called the body corporate). By uncovering details that aren’t visible during a standard property inspection, a strata report provides insight into the behind-the-scenes operations of the building.

Difference Between a Strata Report and a Building Inspection

| Strata Report | Building Inspection |

| Reviews management practices, bylaws, and meeting minutes | Assesses the physical condition of the property and common areas |

| Evaluates financial records, levies, and insurance coverage | Identifies structural issues, defects, or pest infestations |

| Highlights disputes or legal matters affecting the owners’ corporation | Focuses on individual unit and building components only |

Both reports are recommended to provide a comprehensive understanding of the property.

Why a Strata Report is Essential

Strata-titled properties involve shared financial and legal responsibilities that are not present in freehold properties. Ownership extends beyond the individual unit to include participation in the management and maintenance of common areas, as well as compliance with the owners’ corporation’s rules. A strata report identifies key factors that can affect ownership and investment value.

By providing transparency, a strata report reduces the risk of unexpected costs, mismanagement, or compliance issues. It enables buyers and investors to make informed decisions, protecting both their financial interests and long-term property value.

What is Included in a Strata Inspection Report

A comprehensive strata inspection report examines the operational, financial, and legal aspects of a strata property. It provides prospective buyers with insights that go far beyond what a standard property viewing or building inspection can reveal.

Property Details

The report begins with foundational information about the property, such as the strata plan number, property address, lot number, and the total number of units in the scheme.

This section identifies the current ownership structure and helps buyers understand the context of the property within the broader complex.

Knowing the scale and composition of the strata scheme is essential, as it influences financial obligations, management complexity, and community dynamics.

Ownership and Voting Rights

Unit entitlement determines both a buyer’s financial responsibility and voting power within the strata scheme.

Each lot is assigned a unit entitlement, which affects how much the owner contributes to levies and their influence in decisions at owners’ corporation meetings. For example, a small unit might have an entitlement of 10, whereas a larger unit could be 15.

Understanding these details ensures buyers are aware of their contribution obligations and the level of influence they will have over management decisions, such as approving maintenance or capital works projects.

Levies and Special Levies

A strata report details all current levies and highlights any previous or proposed special levies. Levies fund the day-to-day operation of the scheme, while special levies are additional one-off contributions raised for major repairs, urgent maintenance, or unexpected expenses.

Reviewing the history and frequency of special levies provides insight into the financial management of the owners’ corporation. A pattern of high or recurring special levies may indicate unresolved building issues or inadequate financial planning, helping buyers anticipate future costs.

Insurance and Compliance

Insurance coverage is a critical component of the report. It includes building insurance, public liability, and work health and safety policies. The report confirms whether the insurance is current, adequate, and compliant with statutory requirements.

Additionally, it reviews compliance with safety regulations, such as fire safety systems, elevator inspections, and building code obligations. This ensures the property meets legal requirements and protects the buyer from potential liabilities.

Bylaws and Restrictions

Bylaws regulate how residents use their units and shared areas. The report outlines rules relating to pets, parking, noise, smoking, renovations, and other community obligations.

Understanding these restrictions is crucial for buyers to ensure the lifestyle offered by the property aligns with their expectations. For example, a strict pet policy or limitations on renovations could affect day-to-day living or long-term investment plans.

Financial Records and Sinking Fund

The financial section provides a detailed overview of the owners’ corporation’s financial health. This includes balances in both administrative and capital works (sinking) funds.

- Administrative funds cover routine expenses such as cleaning, utilities, and minor maintenance.

- Capital works funds are reserved for major repairs, structural maintenance, or future renovations.

A well-managed fund indicates financial stability, while deficits may signal potential risks, including the likelihood of special levies. Buyers can use this information to assess whether the property is financially secure and sustainable.

Legal Disputes and Building Defects

Strata reports also identify any ongoing or past legal disputes within the owners’ corporation or involving residents. It also details any known building defects, planned major works, and historical maintenance issues.

Understanding these matters is essential for evaluating the property’s risk profile. Properties with unresolved disputes or recurring defects may affect living conditions, resale potential, and rental income. A strata report allows buyers to anticipate challenges and make informed decisions about the viability of their investment.

Additional Insights Provided by a Strata Report

Beyond these core elements, a strata report may also include:

- Meeting Minutes Review: Summaries of owners’ corporation meetings to identify recurring issues or decisions affecting future costs.

- Future Works Forecast: Planned capital works or upgrades that could require additional levies.

- Management Assessment: Evaluation of how efficiently the owners’ corporation is run, including the responsiveness of the strata manager or committee.

- Compliance Alerts: Notes on potential breaches of regulations, safety codes, or bylaws.

By covering these areas, a strata inspection report gives a holistic view of the property, highlighting both opportunities and potential challenges. It equips buyers with the knowledge needed to make informed decisions, reducing the risk of unexpected expenses or management issues after settlement.

What to Look for in a Strata Report Before Buying

Receiving a strata report is only the first step; understanding what to look for is essential to making a sound investment. While some warning signs are obvious, others require careful review to assess their long-term implications.

Signs of Poor Financial Health

Financial stability is a critical factor in the success of a strata scheme. Key areas to examine include:

- Capital Works Fund (Sinking Fund): Ensure there are sufficient reserves to cover forecasted repairs and maintenance. Repeated special levies often indicate poor financial planning or underfunded reserves.

- Quarterly Levies: Extremely low levies may seem attractive initially, but schemes charging less often struggle to fund routine maintenance, leading to deferred works and expensive one-off assessments later.

- Insurance Coverage: Confirm that insurance policies reflect current property valuations and are up to date (typically no older than five years). Inadequate coverage exposes owners to significant financial risk in the event of major damage.

A financially healthy scheme provides confidence that maintenance will be handled responsibly and avoids unexpected costs.

Unresolved Legal Issues

Legal disputes within a strata scheme can have significant financial and operational impacts:

- Ongoing Litigation: Check whether the owners’ corporation is involved in disputes with residents, tenants, or external parties. Legal costs can drain funds and affect the smooth running of the property.

- Tribunal Applications: In NSW, cases brought before NCAT (New South Wales Civil and Administrative Tribunal) signal unresolved issues that may affect property value. Legal disputes can reduce property values due to reputation and operational risks.

Identifying these issues early allows buyers to weigh potential costs and risks before committing.

Major Building Defects or Repairs

Structural and maintenance problems are common in strata properties:

- Prevalence of Defects: A majority of strata buildings have at least one known defect. Common issues include waterproofing failures, cladding non-compliance, and plumbing problems.

- Impact on Owners: Defects can disrupt daily life through noise, restricted access, or safety concerns, and lead to substantial financial obligations.

- Capital Works History: Review past maintenance records for patterns of recurring issues. Frequent work may indicate persistent underlying problems. Special attention should be paid to combustible cladding or other remediation requirements.

Understanding these risks ensures buyers are prepared for potential remediation costs and ongoing maintenance obligations.

Frequent Disputes or Poor Management

The quality of management and the nature of resident interactions are also key indicators of a well-run scheme:

- Meeting Minutes: Examine records for frequent disputes or complaints. Regular conflicts may indicate design flaws, poor management, or governance issues.

- Management Turnover: High turnover among strata managers or committee members often points to systemic problems.

- Maintenance Response: Delays in addressing maintenance requests suggest ineffective management practices.

Since 2018, court cases related to strata management disputes in NSW have increased by 30%, highlighting the prevalence of these issues. Poor management not only affects daily living conditions but can also reduce long-term property value and rental potential.

Real-World Lessons from Sydney’s Building Challenges

Buying a strata-titled property might seem like you’re buying any property. However, hidden structural issues can turn your investment into a financial nightmare. Recent high-profile cases in Sydney have highlighted the critical importance of strata inspection reports in identifying potential risks before you commit.

Combustible Cladding

Many buildings constructed with aluminium composite panels (ACP) containing polyethylene have proven to be highly flammable. Fire incidents in these buildings can spread rapidly, causing evacuation and massive rectification costs. Notable cases include:

- Lacrosse Tower, Melbourne (2014): Fire spread up 13 floors in minutes due to flammable cladding. Owners later won a VCAT case against the builder, though insurers pursued sub-consultants.

- Neo200 Tower, Melbourne (2019): Fire triggered by ACP cladding prompted mandatory removal and replacement works.

State governments in NSW, VIC, and QLD now offer rectification programs, but costs can reach in the millions per building. A professional strata report flags the presence of combustible cladding in fire safety documents, defect schedules, and meeting minutes, helping buyers understand potential future liabilities.

Concrete Cancer

Concrete cancer, or spalling, occurs when steel reinforcement inside concrete corrodes, causing cracks and structural degradation. Sydney has a significant number of older strata buildings with this issue. Left unchecked, repair costs can escalate dramatically, sometimes reaching hundreds of thousands per unit.

Structural Cracks

Structural cracking, as seen in Opal Tower, Sydney (2018), can force building evacuations.

- Opal Tower experienced cracks in load-bearing walls shortly after residents moved in, leading to multiple tribunal and court actions, with independent engineering reports commissioned by the NSW Government.

- Similarly, Mascot Towers (2019) faced major structural failures, leaving owners exposed to tens of millions in rectification costs without builder warranties.

Waterproofing Issues

Poor waterproofing in balconies, bathrooms, and terraces is a common source of recurring defects in many Sydney strata buildings. Undetected issues can lead to internal water damage, mould, and structural weakening, often resulting in expensive rectification works funded through levies or special contributions.

Why This Matters for Buyers

A detailed strata inspection report identifies these defects before settlement, reviewing minutes, insurance, fire safety, and building defect records. Early identification allows buyers to assess risks, negotiate with sellers, or even walk away from properties with high remediation costs.

To understand why these defects are happening and how to protect yourself, read our in-depth article: The Impact of Sydney’s Building Boom on Inspection Standards.

Who Should Conduct The Strata Inspection?

While it is technically possible to review strata records yourself, but it can be complex and time-consuming. Hiring a professional strata inspector provides expertise that far exceeds what a DIY approach can deliver.

Licensed inspectors (like the team at BeSafe Building Inspections) bring experience in spotting warning signs and red flags that an untrained eye might overlook. They also have the skills to interpret complex strata documentation, financial statements, and meeting minutes accurately. This ensures that potential issues, financial, legal, or operational, are identified before settlement.

What Makes a Good Strata Inspector?

When selecting a strata inspector, look for the following qualifications and attributes:

- Professional Credentials: Fully qualified with an extensive property background

- Insurance Coverage: Adequate professional indemnity insurance to protect both parties

- Technical Expertise: Licenced builders, surveyors, or architects capable of assessing more than cosmetic improvements

- Strata Experience: Demonstrated experience with strata documentation and relevant Australian Standards

- Verification: Always confirm credentials and insurance status, as the industry is still largely unregulated in some areas

How Long Does the Process Take?

Most strata inspectors require 2–3 days’ notice to access records and conduct the inspection. The duration of the inspection depends on the strata office’s organisation and record-keeping. Typically, inspectors review approximately five years of documentation to establish patterns in management, maintenance, and financial handling.

Reports are generally delivered within 48–72 hours after inspection, giving buyers timely access to critical information.

Cost and Value of a Strata Report

Professional inspections in Australia typically range from AUD 250 to AUD 400, depending on the property’s size and complexity. Considering that most property purchases involve hundreds of thousands of dollars, this cost is a small investment in risk management.

Why It’s Worth the Investment

The value of a strata report should not be measured by its cost, but by the potential financial risks it helps avoid. Poorly managed strata schemes can reduce property values and create ongoing financial liabilities.

Special levies can run into thousands of dollars per unit, legal disputes may deplete building funds over extended periods, and major defects discovered after purchase become the responsibility of the owner.

Thus, a professional strata report identifies these risks before settlement. BeSafe Property Inspections reviews several years of records to uncover patterns of poor management, underfunding, or recurring issues.

Using the Strata Report to Make a Smart Decision

Negotiating Based on Findings

Most strata reports reveal some issues, ranging from minor maintenance backlogs to slightly underfunded capital works funds. Buyers can use these findings strategically during the conditional sale period.

- Price Negotiation: Compile all issues identified in the report and estimate their financial impact. Present the seller with specific, well-supported requests for price reductions or other concessions. For example, if the capital works fund shows a shortfall for planned roof repairs, this figure can form the basis of negotiations.

- Pre-Settlement Resolutions: Alternatively, negotiate for the seller to address certain issues before settlement. This ensures that repairs or maintenance are completed without additional cost to the buyer.

The key is using tangible figures from the report to substantiate requests, rather than vague concerns, which increases the likelihood of a favourable outcome.

Walking Away from Risky Properties

Certain red flags should prompt serious reconsideration of a purchase:

- Ongoing legal disputes within the owners’ corporation

- Major unresolved defects or significant upcoming repairs

- Serious financial instability in the strata scheme

- Restrictive by-laws that may not suit the buyer’s needs

If the strata report reveals multiple serious issues or a consistent pattern of poor management, it may be wiser to withdraw from the purchase. Consulting a conveyancer to assess the implications of ongoing litigation, maintenance deficits, or structural concerns is essential. Walking away from a high-risk property can prevent years of stress, unexpected costs, and potential financial loss.

Planning for Future Costs and Levies

A strata report also serves as a roadmap for future ownership costs:

- Financial Forecasting: Review both administrative funds (covering day-to-day expenses) and capital works funds (for major projects). Low levies often signal insufficient funding, potentially leading to steep increases or special levies in the future.

- Capital Works Planning: Examine to understand upcoming projects and anticipate future levy requirements. For example, if new lifts or major building repairs are scheduled in the next few years and the sinking fund is underfunded, these costs should be factored into the purchase decision.

- Budgeting for Contingencies: Use the report to prepare for expected and unexpected expenses, ensuring that ownership remains financially manageable and sustainable.

The Bottom Line

Property investment decisions carry long-term financial consequences, particularly when strata schemes conceal issues that only emerge after settlement. What appears to be a dream apartment today can quickly become a costly burden if financial, management, or maintenance problems are overlooked.

A strata report provides buyers with a clear view beyond cosmetic features. It reveals the financial health, management quality, and potential risks that determine whether a property will be a sound investment or a source of ongoing expenses.

The upfront cost of a professional strata report protects against much larger future expenses. More importantly, it places buyers in control of the purchase process, enabling informed decisions rather than leaving them to deal with unexpected problems after settlement.

BeSafe Property Inspections has extensive experience as licensed builders and property inspectors. Our strata reports are designed to provide detailed, actionable information, helping buyers negotiate effectively, identify deal-breakers, and plan for future costs associated with ownership. Book your report today.

Featured news articles

Dilapidation Reports: What They Are and Why Property Owners Need Them

Learn what a dilapidation report is, why it’s essential before construction or demolition, and how it protects property owners from damage claims and disputes.

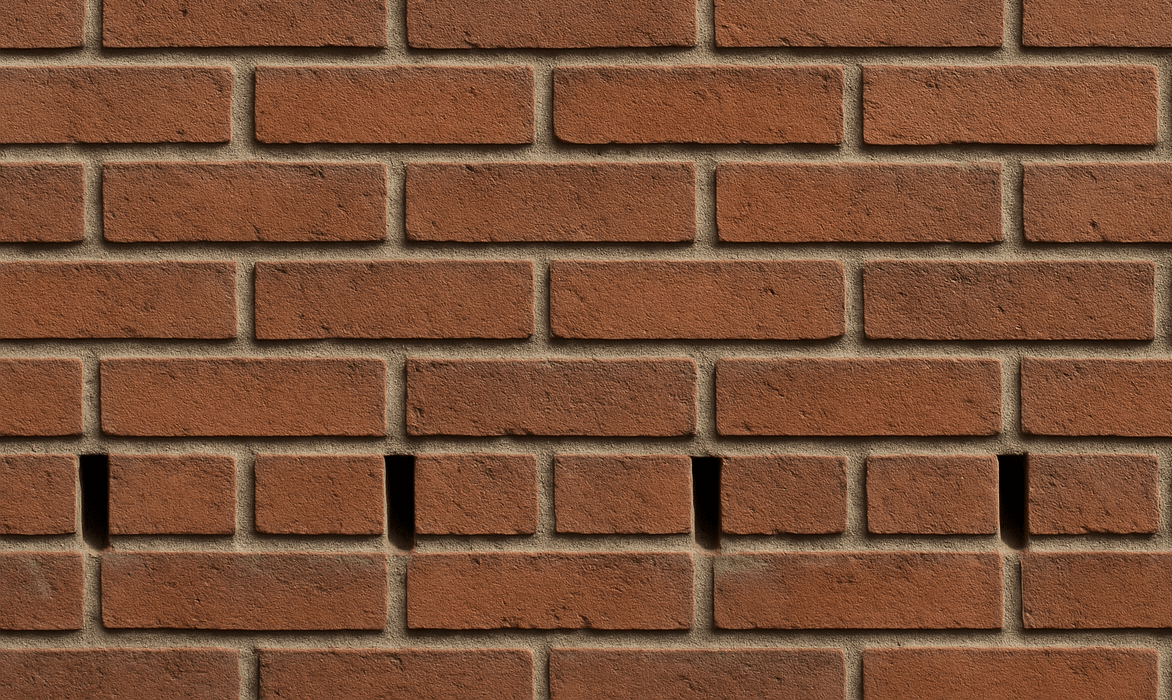

What are Weep Holes in Brickwork? Why Pre-Purchase Building Inspections Are Important

Learn what weep holes are, why they are vital for your home’s structural integrity, and how professional property inspections can prevent costly moisture and pest damage.

What is a Strata Report? Your Essential Guide Before Buying Property

Discover what a strata report is and why it’s crucial before buying a strata-titled property. Learn how it reveals financial, legal, and management insights to protect your investment.

How To Spot Drainage Problems: 9 Warning Signs To Look For Before Making A Purchase

Discover the 9 most common drainage issues to spot before purchasing a property. Protect your investment, learn expert tips to avoid costly repairs. Read now!

Top 7 Building Defects Found in New Sydney Properties: How to Spot Them

New doesn’t always mean defect-free. In Sydney’s booming property market, construction issues are more common than many buyers realise. From waterproofing failures to structural cracks, this guide breaks down the 7 most frequent defects found in new builds, and how to detect them before they escalate.

Pre-Purchase Building Inspection vs Pest Inspection: What You Need To Know

Buying property? Learn the key differences between pre-purchase building inspections and pest inspections, and why relying on just one could leave you exposed. Learn how these two essential inspections work together to give you a complete picture of a property’s condition, uncover hidden risks, and help you make a confident, informed investment decision.

Ultimate Personal Property Inspection Checklist Before Booking an Inspection

Discover why having a personal property inspection checklist is essential before booking a professional inspection. Taking the time to walk through a property with your own checklist allows you to identify areas of concern, prioritise your questions, and ensure nothing is overlooked. While it won’t replace the expertise of a licensed inspector, it empowers you to approach the inspection process with greater clarity and confidence.

First-Time Buyer’s Guide to Property Inspections in Sydney

Purchasing your first home in Sydney? Don’t skip the property inspection. This comprehensive guide provides key insights into what to expect during an inspection, common issues to be aware of, and how a professional assessment can protect your investment and save you money in the future.

The Impact of Sydney’s Building Boom on Inspection Standards

Sydney’s building boom is fueling rapid development, but it’s also raising concerns about the integrity of both NSW building standards and inspection quality. As construction accelerates, reports of defects are on the rise, raising concerns about the long-term integrity of new properties. With increasing pressure on the construction industry, learn how this affects inspection standards and what it means for property buyers.

How Much Does A Building Inspection Cost In Sydney?

A building inspection is an essential step in the Sydney property purchasing process, providing buyers with critical insights into potential structural issues and hidden defects. Inspection costs vary based on property size, type, and additional services required. This guide offers a comprehensive overview of building inspection pricing, key cost factors, and strategies to ensure purchasers receive the best value for their investment.

Should You Be Present at a Building & Pest Inspection? What You Need To Know

When you’re in the process of buying a property, a building and pest inspection is a crucial step in making sure you’re making a sound investment. However, one common question is whether it is necessary to attend the inspection in person. While it may seem convenient to forgo being present, attending the inspection offers valuable opportunities to gain insights directly from the expert.

What Is An Unsatisfactory Building Inspection?

An unsatisfactory building inspection can uncover hidden issues that may impact your property purchase. From structural concerns to plumbing and electrical problems, understanding what these findings mean and how to handle them is crucial.

Signs It’s Time To Walk Away From A Property

Investing in a property is exciting, but hidden building faults, pest damage, and financial red flags can all indicate it’s time to reconsider your choice. Understanding these crucial warning signs can help protect your investment and ensure you find a home that meets your needs

How To Find The Right Building Inspector

Discover essential tips for finding the right building inspector in Australia. Learn what to look for, questions to ask, and how to ensure you choose a qualified professional for your property inspection needs.

What Does a Building and Pest Inspection Cover?

A building and pest inspection is vital for any property transaction. This guide covers what these inspections include, from structural assessments to pest detection, and explains why they’re essential for safeguarding your investment. Learn about the advantages of professional inspections and find out how BeSafe Inspections can help ensure your property is in top condition.

Introducing our new strata inspector

BeSafe’s Strata Inspector Tina has joined the team to help us expand our capacity for delivering strata reports to unit and apartment buyers in Sydney.

Why Sydney homebuyers need independent property inspection reports

Property inspection reports are essential for Sydney buyers who want to ensure they get exactly what they are paying for.

Before you buy: Is your new house hiding leaks?

If you’re looking to buy a home in Sydney, a pre-purchase building inspection is vital to detect household leaks and rising damp.

Common Defects Found In Buildings

If you’re in the process of purchasing a new property, it can be daunting to consider the repairs it may need. Discover the most common building defects, their causes, and how to address them effectively to make informed decisions and protect your investment.

Building Inspections

Looking to purchase a property but wondering if you actually really need a building inspection

The Cause Of Wall Cracks

Understanding the cause requires consideration of a large number of factors

Cracks in Buildings

The sight of cracking can set off alarm bells in anyone considering purchasing a property